#1 Thing in all of Trading – RISK Management

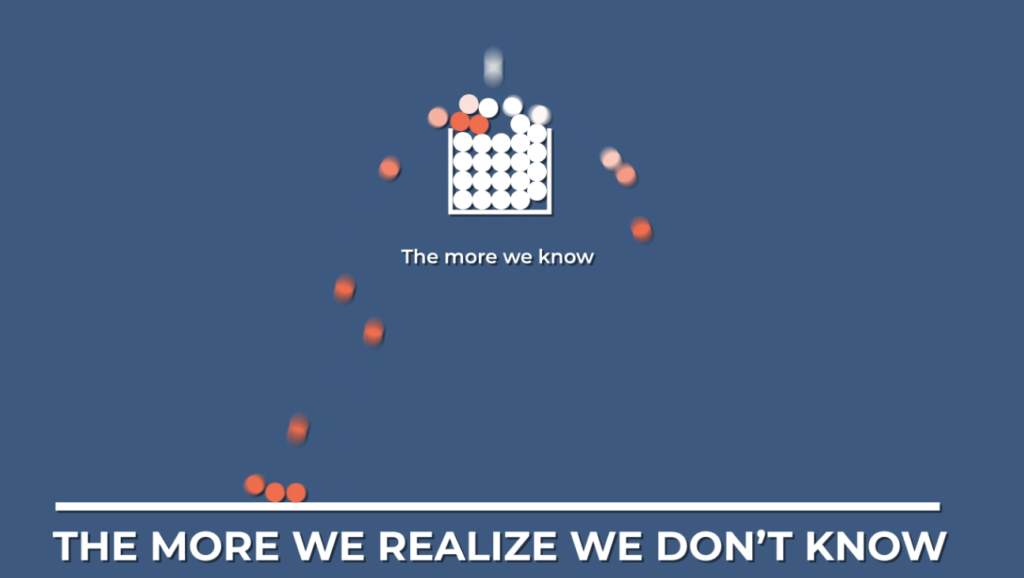

The more we know, the more we realize we don’t know.

Our experience is an ever expanding circle. The knowledge we have, that is, what we know, is represented by the inside of this circle.

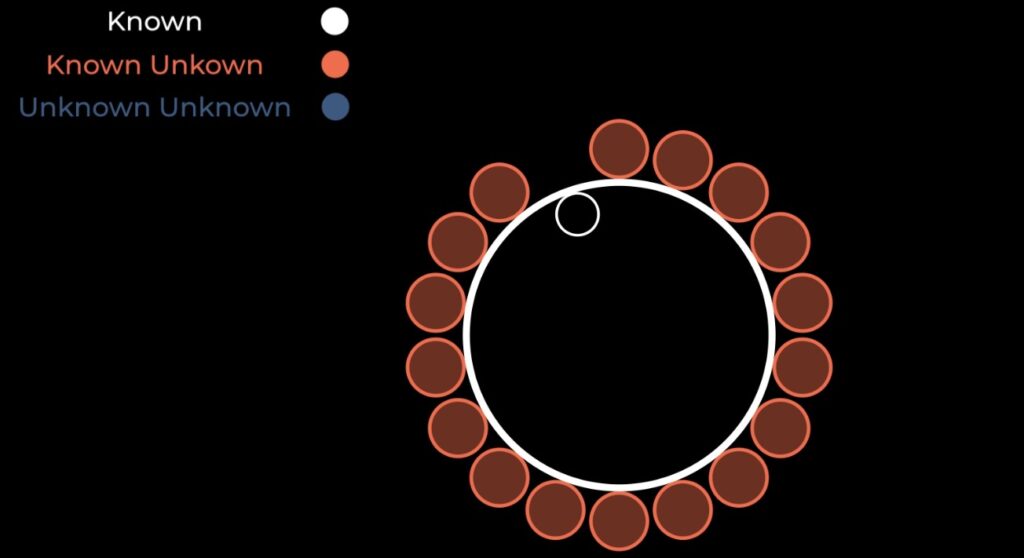

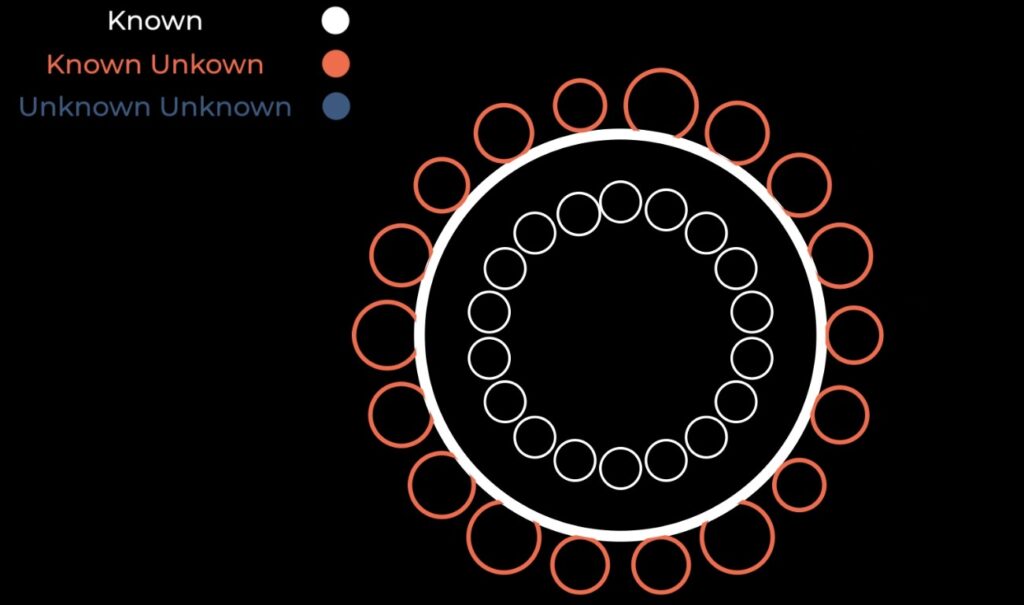

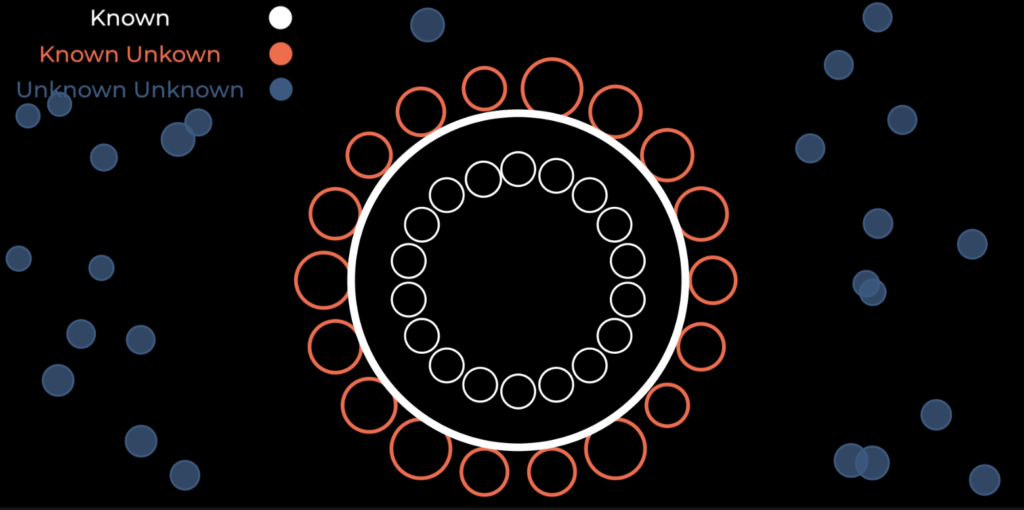

As our experience grows, we become aware of things that we don’t know. Just outside of our knowledge is an ever growing collection of Known Unknowns.

So there’s what we know, and there’s what we know we don’t know. As what we know expands, so does what we know we don’t know

But that’s not all. If by gaining experience, we continue to uncover more known unknowns, that means that outside of this exists a world of unknown unknowns. A world we have yet to discover.

These are things that we don’t yet know, we don’t know.

So there’s what we know, what we know we don’t know, and what we don’t yet know we don’t know.

Which brings us back to, the more we know, the more we realize we don’t know.

This applies to trading and investing, just as much as anything else in life.

Warren Buffet famously said that Risk comes from not knowing what you are doing.

The most simple description of risk, is that more things can happen than will happen.

Putting all of this together, the inexperienced trader dismisses risk, because his experience has not yet revealed to him all of that which he does not know. He believes he’s about to get rich in a short period of time, and then the unknown unknowns creep in and shatter that dream.

The experienced trader, through pain and loss has become acutely aware of what he does not know, and the existence of the things he doesn’t know he doesn’t know…. And for that reason the experienced trader sees Risk management as the single most important component of his trading… period.

It aint what you don’t know that gets you into trouble, its what you know for sure that Just aint so. – Mark Twain

Large losses are forever, when it comes to betrayal, when it comes to family, when it comes to accidents, but especially when it comes to investing and trading.

Mathematically we can prove this fact.

If I have a 100,000 dollar account, and suffer a loss, due to an unknown risk, of 30%. Then I will now be left with a balance of 70,000 dollars.

Through discipline and hard work, over time I achieve a 30% gain on the funds I have remaining.

This increases my account by 21,000 dollars bringing me to a total account value of 91,000 dollars.

A devastating loss, followed by an exceptional return…. And yet mathematically I am still down 9% from where I started, and add to that, I’ve lost the most valuable thing of all…. time.

This is why we cannot afford to take large losses. The larger the loss, the more mathematically improbable it is that we can ever recover.

Losses of this magnitude consistently happen to those traders who are not yet aware of all of the many things they do not yet know.

We avoid large trading losses with strong and intentional defenses. When we do this, we make way for the winnings to pile up. Losses that are too big, are almost always the result of trying to get too much too fast and taking on unreasonable risk out of ignorance and/or greed.

Ignorance is painful, and greed always ends with us having less.

Risk is often synonymous with uncertainty. We throw that word around casually, risk this, risk that, risk here, risk there and we don’t want to acknowledge that the risk comes from us not knowing, but the truth is we don’t know.

We have to protect our money from danger, and WE are the danger.

We are unconsciously incompetent; we don’t know and we don’t know that we don’t know. The goal for our trading and life for that matter, is to move into a place of being consciously incompetent. A place where we don’t know and we are acutely aware of the fact that we don’t know, so we practice risk mitigation.

The Risk comes from what we do not know.

People think that the objective of Trading and investing is to take a risk in order to get a return. But Smart traders find opportunities to achieve a higher-than-average return and combine that with a safety net for protection.

The best traders do not seek returns first, they do not go out and look for the largest payday.

Instead they focus on and try to understand the risk first, then determine if the return justifies taking on that risk.

If I am right, how much am I going to make and if I am wrong how much am I going to lose? Now based on historical statistics how often do I expect to be right and how often can I expect to be wrong.

That math has to work, and we need to accept it before we put our money into anything.

And if I’m wrong way more than I anticipated, what will I lose then? And am I comfortable with that?

But we don’t just cap our risk, we also spread it out. This is known as diversification.

Risk diversification isn’t just a good defense, its also a great offense, because it exposes us to return diversification as well. That is, it exposes our portfolios to a broader range of opportunities to make money. The only reason a person wouldn’t do this, is because they are a fool who thinks they know the future. That kind of person is fit for a straight jacket.

Risk is always everywhere, and it always comes from the same place, not knowing.

But you cannot avoid risks, that’s the best way there is to lose. You have to plan for it.

Everything has a risk component. Its all risky, relationships, driving, kids, careers, life, marriage….. is risky.

But if you think investing is risky, wait until you get the bill for not investing.

The only risk you should avoid at all costs is the risk of not doing anything at all….

That’s the biggest risk there is, doing nothing because you are afraid of risk.

I don’t know a way to guarantee success, but I do know a way to guarantee failure, just do nothing, live in fear and take no risks.

So we don’t avoid risk, the goal is to be aware of risk and to do our best to manage risk intentionally and safely.

When you check the depth of the river, you don’t have to use BOTH feet.

It’s like, Ya know if things don’t go your way and you gotta jump out of a window someday, make a plan to do it on the first floor.

You gotta take on risk but the only appropriate risk to assume is calculated risk, that means you make a plan for it.

Here are some of the best ways I know of to plan for it.

Diversify Asset Classes, don’t put all your eggs in one basket, because ya might drop the basket. Invest in Equities(stocks) , Real Estate (single family, multi-family), Fixed-Income (Muni bonds, T-bills), Private Equity (best way to do this is to start a business or you can invest into another privately owned business), Commodities, Digital Assets, and alternative investments (a good example of this is hard money lending, we are in a good interest rate environment for that))

Define Risk on every trade, on every investment, on every decision, know your max loss and know your likelihood of that max loss. If you don’t understand the investment vehicle, don’t put your money into it…. ever

Within Trading itself, there’s Diversification of Trading vehicles – Some Stocks, Some ETFs, Some Options on Both, you can buy options or sell options, you may like futures or you may like Forex, you may like crypto.

Never risk more than 2-3% of your total account on any one trade. You can put more than that percentage into a trade, but you cannot lose more than that percentage, so set your stop limit orders appropriately, and give yourself lots of wiggle room, or buy the appropriate number of contracts.

To win you must survive long enough for your edge to play out, its all about the probabilities, and probabilities only work on large sample sets… so you need volume, for dummies that means lots of trades have to happen, which means you must survive long enough to do this without quitting or going broke.

Volume negates luck, both good luck and bad luck… lean on the math, not luck, to do that you cannot lose more than 2-3% on a trade. I currently only risk 1%.

Correlation – You Want to be as non-correlated as possible, this way a falling tide doesn’t shipwreck all the boats at once. Plus when you diversify your risk in this way, you also diversify your opportunities. For traders, there are free programs available online that let you see the correlation of all your current trades… just type in the tickers.

Diversification of Holding Period – 2 weeks, 4 weeks, 6 weeks, 1 year, 10 years, forever, hold different investments for different periods of time. I do not suggest anything intraday… It’s too random and it causes too much negative emotion.

The secret to making money with assets isn’t about buying a Good asset or an asset that is better than some other one.

The secret is to buy an asset when it is cheap, and sell it when it gets expensive.

You make money when you buy the asset for less than its worth.

But also you have to cap the downside, sometimes cheap things get a lot cheaper, and sometimes cheap things lose all value entirely.

If you can cap the downside risk, and trade frequently enough and diversify your assets enough, time takes care of everything else. But you gotta be patient, and you have to control your greed.

Nobody knows nothin, that’s especially true when we’re talking about the future, so position yourself accordingly, and I bet you can still win without knowing nothin.

Powerfull teaching here again. This is the 2nd newsletter I’m reading (season 2 – I was a subscribers years ago when debuted on YouTube) and I love them! As usual, Trent, I’m one of your biggest fans.